NAVIGATION

Like a lot of minimalist-focused practices, living well on less money comes down to intentionality and mindset. Living well while spending less means you are truly aware of your finances while choosing to work toward (and achieve) financial stability. Minimalism has positively affected so many areas of my life, but the financial transformation it has brought about for me is priceless.

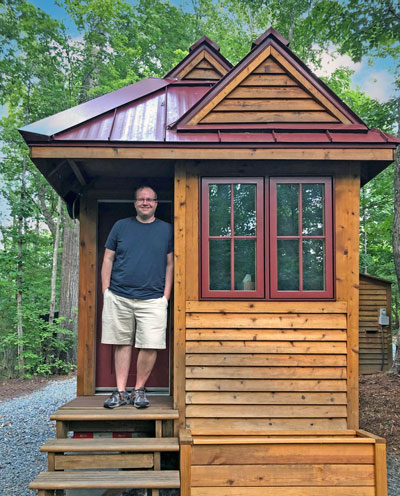

Hi, I’m Ryan

Hi, I’m Ryan. I’ve Improved nearly every aspect of my life using minimalist practices, but nothing compares to the way minimalism has helped me learn to live well on less money. Being more thoughtful and logical about my spending choices has changed my outlook and bank account for the better.

Learning how to live a fulfilling life on less money has not only helped me to achieve my goal of living debt-free, but it has also helped me to appreciate more of what’s in front of me.

With a little shift in perspective, I found that minimalist budgeting techniques and strategies left me with more room for the things that matter. When I took control over my finances with minimalism, I found more peace of mind and paid off my debt, all without sacrificing my happiness and quality of life.

How Minimalism Helps You To Live Well On Less Money

I found that it was more about being aware of the state of my finances and taking the necessary steps to take charge of my money and future without sacrificing what I feel is important.

Minimalism helps me spend less by reducing the number of things I own and need, but it also helps me live better by shifting my mindset to focus on the stuff that matters, like spending more time with family and friends or investing in my passions and hobbies.

Why Live On Less Money Through Minimalism?

I don’t think it’ll come as any surprise that I decided to live on less money for the simple reason of saving more and spending less. I always hated debt and feeling like I couldn’t afford the things I wanted to do, like traveling or contributing to my retirement fund.

Defeating debt, putting more money into savings, and rediscovering what you care about most are only a few of the many benefits of using minimalism to live well on less money. Applying minimalism in this way can help cut down financial stressors, prepare for the unpredictable, and create a lifestyle focused on quality instead of quantity.

How Minimalism Can Help Eliminate Financial Stress

For me, living on less money alleviated some of my most stressful money concerns. I became debt free a lot faster than I anticipated, giving me the chance to start saving right away. Before switching over to simple living, I spent a lot more physical and mental energy figuring out my budget and finances. Once I simplified my life, by budget followed suit.

What was the most surprising part of all this was that once I got my expenses under control, not only did my expenses go down, but my income went up! I had never expected this, but the extra sense of security from knowing I was in control of my finances meant that I could start to get out of the day-to-day grind and look towards the future. That opened me up to opportunities that increased my income.

What was the most surprising part of all this was that once I got my expenses under control, not only did my expenses go down, but my income went up! I had never expected this, but the extra sense of security from knowing I was in control of my finances meant that I could start to get out of the day-to-day grind and look towards the future. That opened me up to opportunities that increased my income.

Though it takes some self-discipline and self-control to master financial minimalism, it leads to a lot less stress and mental strain. For a lot of people, financial stress comes as a result of having personal debt, not making as much money as they’re spending, living paycheck-to-paycheck, or getting hit with unexpected expenses.

What Minimalism Taught Me About Investing In The Future

Aside from having money tucked away for emergencies, living on less can also help you invest in future goals, whether that’s funding a big trip, retirement, or some other milestone.

I know at times it can be difficult to stay future focused, especially when there are needs and wants that feel crucial right now. When I was new to minimalism, I remember it being really hard to step back and see the big picture and longer timeline.

I know at times it can be difficult to stay future focused, especially when there are needs and wants that feel crucial right now. When I was new to minimalism, I remember it being really hard to step back and see the big picture and longer timeline.

Now, as a seasoned minimalist, I can see how being future focused has saved me a lot of headaches, time, and especially money in the present. There are a lot of ways financial minimalism can help you invest in the future, including retirement funds, college savings plans, emergency funds, and general savings accounts.

The lesson I learned here was that budgeting as a minimalist put me into a positive feedback loop. Each step I took had a positive impact on my life, which incentivized me to keep on going. After consistently making smart money decisions, I ended up in a much better place and feeling great along the way.

Living On Less Doesn’t Mean Lacking

If there’s one thing minimalists know, it’s that having less doesn’t mean you’re lacking in happiness or experiences. In fact, keeping fewer possessions and spending less on trivial things actually helps you live a more fulfilling life.

Instead, minimalism encourages participants to put more thought and meaning into purchases and possessions. This often means working basic necessities into your budget, like food, water, or (for me) Wi-Fi, while scrapping splurges like seasonal décor or frequent stops at the local coffee shop.

Instead, minimalism encourages participants to put more thought and meaning into purchases and possessions. This often means working basic necessities into your budget, like food, water, or (for me) Wi-Fi, while scrapping splurges like seasonal décor or frequent stops at the local coffee shop.

In return for that cost-consciousness, minimalists can often afford to invest in higher-quality items that will last longer or do the job better, and save leftover funds for a rainy day. What I ultimately realized was that I wasn’t taking things away, I was just making more space for what is important.

There are a surprising number of items that minimalists really don’t need, and by eliminating those purchases from your regular buying cycle, you may quickly find yourself living well while spending a lot less.

Enjoying More Of What You Have

Over the course of my minimalist journey, I’ve learned that time is extremely important to me, so by spending more time on contemplating purchases, I also can appreciate them a bit more.

When spending with care and being conscious about what you invest your money in, you may find that your purchases and other investments become more meaningful.

Prioritizing Money For What’s Important

When I figured out what was necessary and what was just excess in my life, I was more aware of what brought me long-term contentment versus a short-term reward. I recognized that the short-term purchases, items, or experiences could even make me feel worse after I realized I wasted $15 that could have been better spent or saved.

A friend of mine described a feeling of general emptiness after shopping out of habit when she was upset instead of coping in a different way that would be cheaper and healthier.

I realized that when I spent money on only the things I really needed, not only was I happier with what I invested in, but I also had more money for my long-term financial goals.

Everyday Practices For Low-Cost Living

Frugal or low-cost practices are a good way to live well while spending less, and are popular among minimalists. Implementing small but strict actions in your spending habits will save small amounts of money daily that’ll add up in the long run.

Depending on how much time you have and what you’re willing to compromise, there are varying stages of frugal strategies. For example, if you’re willing to be a little bit warm or cold at home, keeping your thermostat a few degrees lower in the winter and a few degrees higher in the summer can save you some money on cooling and heat.

Depending on how much time you have and what you’re willing to compromise, there are varying stages of frugal strategies. For example, if you’re willing to be a little bit warm or cold at home, keeping your thermostat a few degrees lower in the winter and a few degrees higher in the summer can save you some money on cooling and heat.

Another idea is to line-dry your laundry if your environment and weather allows for it. There are also hobbies that are naturally money saving like gardening, which will save a few bucks when it comes to fresh produce, and if you know how to can and store food, that’ll save you even more money.

Then there a few habits you might already be doing that you can enhance by just being conscious, like turning off lights and fans in rooms that you aren’t using, making sure not to keep water running when brushing your teeth and doing dishes, or even using the dishwasher if you have one to save money on your water bill.

Cut Back On Big Things

I’ve often said that just cutting lattes isn’t going to do it. People often look at small things to cut, but don’t always consider points where they can get the most leverage. When I lived in my old apartment, I realized half my income was going to housing. Moving into a tiny house meant that I took my monthly spending from $1,500 down to $15! That’s not a typo!

Look for places that you can win big, but also realize you can only cut so much. Once you cut back to just your true necessities to live, you can shift your focus to the income side of things. In the beginning, there is often a lot of excess to cut from your budget, but you’re quickly going to reach a point of diminishing returns and will need to look for ways to increase your income to save faster.

Look for places that you can win big, but also realize you can only cut so much. Once you cut back to just your true necessities to live, you can shift your focus to the income side of things. In the beginning, there is often a lot of excess to cut from your budget, but you’re quickly going to reach a point of diminishing returns and will need to look for ways to increase your income to save faster.

Again, these options may only be a possibility depending on your lifestyle and current situation — they aren’t for everyone.

How To Create A Minimalist Budget

Creating a minimalist budget will help you make a realistic and actionable plan to stay true and committed to living well on less.

There are a few different strategies you can implement when it comes to budgeting with a minimalist focus. The first step is to really look at why you want to revamp your budget. Then set a financial goal to keep you motivated. Finally, create a plan to help with accountability and find the best budgeting and money-saving techniques that work for you.

To learn more about this, check out my post on how to start your own minimalist budget.

Living Well On Less Is About Less Money, But Higher Quality

When living on less money, it doesn’t have to mean that you get low-quality items and experiences. By spending less overall, you can save up for better quality purchases that are more durable to last longer, which will save money in the grand scheme of things.

You can also save your money to spend it on things that matter more to you, such as travel, time spent with loved ones, heading back to school, or building your own tiny house.

You can also save your money to spend it on things that matter more to you, such as travel, time spent with loved ones, heading back to school, or building your own tiny house.

By spending less money, you’re able to feel a greater sense of value in what you do spend money on and appreciate the small things more.

Overall, living on less enhances quality in daily things and activities, and helps you focus on goals, passions, and relationships in life.

Your Turn!

- What’s one of your spending habits you’d like to change?

- If you made a list of your daily expenses, how many of them would be wants versus needs?

Ryan,

I have a found a tiny house that I like, however, I did not find a SKU for the structure. I look again, and I will let you know the reference number.

Mary Odom

I’d like to quit spending just because i have a coupon. I recognize that i have spent money, rather than saved money, but somehow it is so ingrained in me to shop for a bargain that i feel guilty if i let a coupon expire.